India Smartphone Shipments Rise 7 Percent YoY in Q2 Vivo Secures Top Spot: Canalys

India’s smartphone market sprung back to life in Q2 2025, leaping 7% year-over-year according to Canalys. After a sluggish start to the year where brands played it safe, a torrent of new devices unleashed pent-up demand. Vivo surged ahead, capturing the crown with a 21% market share, leaving Samsung in its wake. Oppo trailed closely behind, while Xiaomi and Realme battled for the remaining top spots in this fiercely competitive arena.

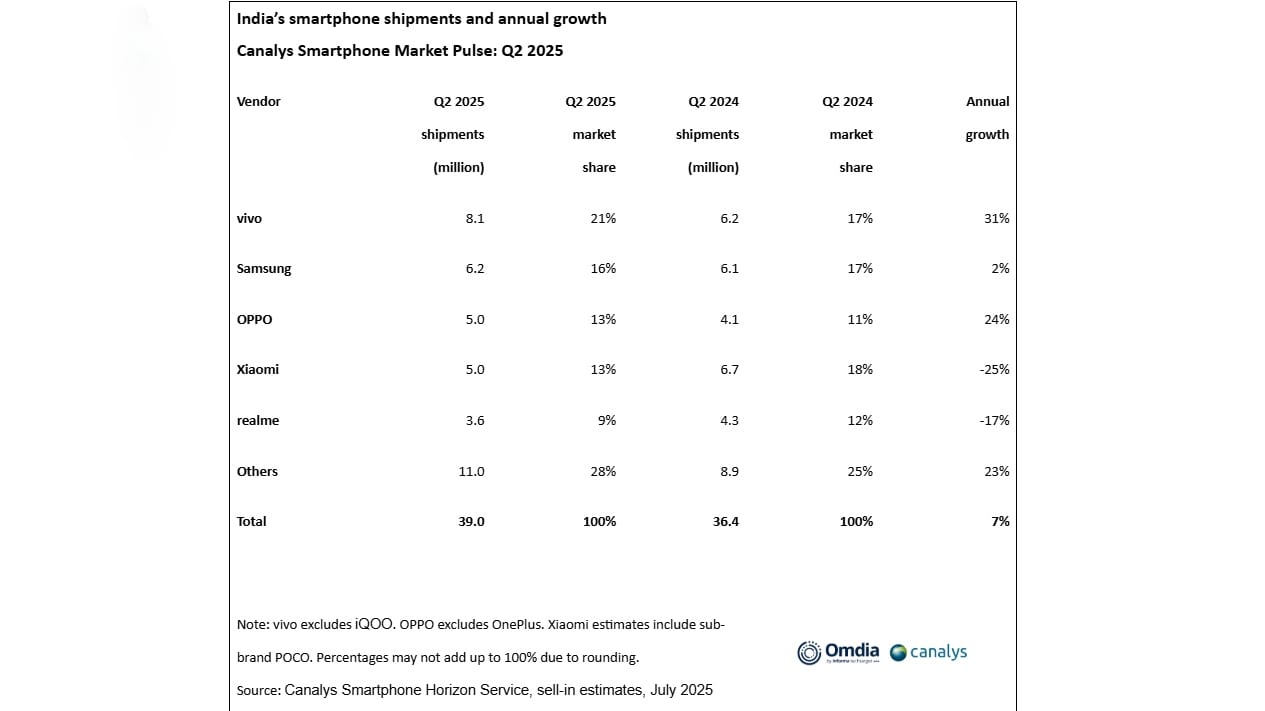

India Smartphone Shipments in Q2 2025

India’s smartphone market surged in Q2, hitting 39 million shipments, a 7% jump from last year, Canalys reports. The surge was sparked by a wave of new phone releases and a rebound from a sluggish Q1 weighed down by excess inventory.

Forget the coronation, it was a market conquest. Vivo stormed to the top of India’s smartphone charts in Q2, shipping a staggering 8.1 million devices and snatching a 21% share of the fiercely competitive market. Samsung, a longreigning titan, trailed behind with 6.2 million units and a 16% slice of the pie. The battle for India’s mobile supremacy is far from over, but for now, Vivo wears the crown.

The battle for smartphone supremacy in Q2 was a nail-biter! Oppo clinched the third spot, shipping 5 million units and edging out Xiaomi by a hair. Both giants grabbed a 13% slice of the market pie. Hot on their heels, Realme snagged fifth place, delivering 3.6 million devices and capturing 9% of the market’s attention.

Photo Credit: Canalys

Vivo painted Q2 green, fueled by the V50 series’ roaring success in major urban centers. But the story doesn’t end there. The ever-reliable Y-series kept the engine humming in smaller cities, while an expanded T-series lineup aggressively conquered online sales, proving Vivo’s multi-pronged approach is a force to be reckoned with.

Oppo’s ascent can be attributed to two key strategies: dominating brick-and-mortar stores with the popular Oppo A5 series and igniting online sales through the Oppo K13 line. Meanwhile, Samsung leveraged its financial muscle, enticing consumers with attractive EMI options, particularly for the Galaxy A36 and A56, securing a strong foothold in the competitive mid-premium market.

Xiaomi claws back ground in Q2, Canalys reports, fueled by budget-friendly heroes like the Redmi 14C 5G and A5. The arrival of the Redmi Note 14 series acted as a booster rocket, offsetting an overall year-on-year dip. Realme faced similar headwinds, but found solid footing offline. The Realme C73, C75, and 14X emerged as champions, proving brick-and-mortar still packs a punch.

Apple held strong at sixth, fueled by the iPhone 16 series, which accounted for over half of their shipments. Interestingly, the iPhone 16e seems to be losing its luster. Motorola maintained its position at seventh, while Nothing experienced a meteoric rise with a staggering 229% year-over-year growth. In a sibling rivalry, Infinix dethroned Tecno as Transsion’s leading brand in India, commanding 45% of the group’s impressive 1.8 million shipments.

India’s smartphone showdown in the latter half of 2025 won’t be about flashy new gadgets, but gritty street-level sales tactics. Canalys Principal Analyst Sanyam Chaurasia suggests that with organic demand sputtering, success hinges on outmaneuvering the competition in the trenches of retail and distribution. Forget fireworks; Canalys forecasts a year of attrition, a slow burn where fundamental market woes will continue to bite.

Thanks for reading India Smartphone Shipments Rise 7 Percent YoY in Q2 Vivo Secures Top Spot: Canalys